- CTC Continuous Transaction Control: It's here to stay

- CTC continuous transaction monitoring: the new language of tax compliance

- Why all the fuss about these controls?

- And when is it my turn? Dates, countries and headaches

- A personal confession about the CTC

- What do you think?

- CTC “Thank goodness I adapted in time!”

CTC Continuous Transaction Control: It’s here to stay

Let’s talk about a topic that, I know, sounds technical and maybe even a little intimidating: CTC Continuous Transaction Control.Have you yet yawned? You needn t feel bad about it, I know. I frowned too the first time I heard those acronyms. But after a couple of coffees and a couple of calls with accountant friends (thanks, Anita!), I discovered that it’s not as horrible as it sounds. In fact, it’s fascinating to see how governments are reinventing the way they police us…I mean, help us file taxes.

And yes, what you are feeling is real: we are entering a new era of tax compliance where the rules are changing fast, as if we were playing a video game with weekly updates.

CTC continuous transaction monitoring: the new language of tax compliance

And what does this mean in human words?

Basically, the CTCs allow the tax authorities to jump in in real time to look at your transactions, almost like they’re looking over your shoulder while you’re doing an invoice. It used to be more relaxed: you did your accounts, filed your reports, and then the government would review. But now, with digitalization, they don’t trust you anymore. They want to see everything instantly.

It’s as if the AFIP, Hacienda or SAT were connected to your fiscal printer. And I’m not exaggerating. In countries like Mexico, Chile and Italy, this is already the bread and butter.

Why all the fuss about these controls?

Because a lot of money is slipping through the cracks, my friend

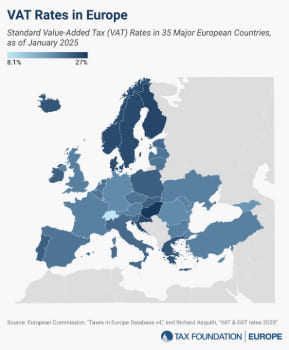

In Europe, for example, it is estimated that the famous “VAT gap” -i.e. what governments should collect vs. what they actually collect- amounts to some 140 billion euros a year. Can you imagine how many pizzas with prosciutto and arugula you could buy with that?

So it’s no wonder that governments like France, Spain, Germany or Poland are implementing CTCs at full speed. It’s a way of make sure that we all pay our fair share… even if it hurts a little bit sometimes.

And when is it my turn? Dates, countries and headaches

France

As of July 1, 2024, all B2B transactions will have to go through the CTC system. In other words, no more “I’ll send it to you by PDF and that’s it”. Everything through official or authorized platforms. Make an appointment with your software provider now.

Germany

There is no official date yet, but it is coming. There are already political discussions, and associations like VeR are pushing hard to implement something similar to the Italian model. In short: get ready.

Italy

Here they did not mess around. As of 2019, all B2B e-invoices go through the SdI (Sistema di Interscambio). Yes, they are the pioneers in Europe. If you are a fan of espresso, you should also admire their fiscal rigidity.

Spain

FACe and FACeB2B are the platforms that already exist, but things are getting serious with the famous “Crea y Crece Law”. Large companies (more than 8 million per year) have only one year to adapt since the law is published. The smaller ones have two. There is no escape.

A personal confession about the CTC

When I first heard about all this, I felt like I was being spoken to in Klingon. But after a chat with a friend who works with exports, I understood that this new model, while controlling (and yes, a bit invasive), also has its good side. For example, it forces you to keep your accounts in order and gives you more visibility on what’s really going on in your business. And while I’m still having a hard time letting go of my old Excel spreadsheet…. I can vouch that it is the right way to go. And how do you think?

What do you think?

Are you already using electronic invoicing systems? Has your country already implemented the CTC continuous transaction control? Have you got a funny (or tragic) experience involving an electronic invoice not being sent? –Tell me about it! Because in the end, we are all in this fiscal boat, trying to paddle with the waves of digital change.

CTC “Thank goodness I adapted in time!”

CTC Continuous Transaction Control is not just a technical acronym: it is a reality that is transforming how we work, how we invoice and how we fulfill our tax obligations. Is it uncomfortable at first? Yes. Is it worth adapting as soon as possible? Absolutely.

And if all this overwhelms you, remember: even the smartest software was created by a human who once also said “what’s this CTC stuff?”.