- How I Survived a Florida Sales Tax Audit

- What exactly is a Florida sales tax audit?

- The psychological game behind the audit

- Presumed guilt (and why that's so unfair)

- To sign or not to sign? Therein lies the dilemma

- Extend the process or close and fight?

- Lessons I learned (and that you should know too)

- In the end, it's more than numbers… it's your peace of mind

How I Survived a Florida Sales Tax Audit

Have you ever received an official letter and had tachycardia before opening it? Well, that’s how my story with the dreaded Florida sales tax audit began. And believe me, it wasn’t love at first sight. But here I am, here to tell you all about it with details, signs… and the occasional uncomfortable confession.

What exactly is a Florida sales tax audit?

It’s not just a simple paperwork review

Let’s cut to the chase: a Florida audit is not just sitting down for coffee with a nice auditor who wants to understand your business. Nope. It’s a meticulous, sometimes relentless process that can end up with five, six or who knows how many figure penalties if you’re not prepared.

In my case, it all started with an official notice. One of those that come in a large envelope with mysterious acronyms like DR-840 and DR-846. The first one, as it sounds, is a complete audit: everything from your invoices to the soul of your accounting. The second is more specific, but beware: some auditors are too clever and use it as if it were a full audit. They tried that trick on me… thank goodness I caught it in time.

The psychological game behind the audit

“Can you waive your 60-day deadline?” – NO!

One of the first little traps I ran into was this: the auditor very kindly asked me to waive my legal 60 days of preparation. Polite, yes… but with a grain of salt. What seemed like a courtesy was actually a strategy to catch me off guard.

And here I ask you:

What would you do if an official insisted on something that sounded legal, but you weren’t quite sure?

I, at the time, hesitated. Luckily, I asked for advice (and didn’t sign anything).

Presumed guilt (and why that’s so unfair)

“You’re guilty until you prove it with paperwork”

One of the most frustrating moments was when I realized that any bank deposit that didn’t perfectly match my reports was automatically treated as a taxable sale. What? What if it was a transfer between accounts? A family loan? None of that mattered… until I proved it.

The logic is absurd: “guilty until proven innocent” – very un-American, isn’t it? But that’s how it works. And that’s when I started collecting every receipt, note and WhatsApp message that could prove that not everything that goes into a bank account is a taxable sale.

To sign or not to sign? Therein lies the dilemma

When your signature can work against you

There are documents that, while sounding harmless, can be the kiss of death for your case. Like the Notice of Intent to Make Audit Changes. Many think that signing it is just a formality, but it’s not. Signing it is like saying, “Yes, I agree with everything you say.”

I was about to do it because I was tired. The auditor was insistent and I had had enough. But I took a deep breath, checked, asked questions… and didn’t sign. That decision saved me literally thousands of dollars.

Extend the process or close and fight?

The dreaded DR-872 and the eternal doubt

At a certain point, you may be offered to sign the DR-872 form. Basically, it extends the audit beyond the legal deadline to continue “working the case.”Is it effective? In certain cases, yes; but in certain other cases, no. It is based on the strength of the defense you have. I decided not to sign it. I was already exhausted and preferred to appeal, even if that meant entering another arena (that of formal protests). But at least I felt I was no longer at the mercy of the auditor.

Lessons I learned (and that you should know too)

Tips the Florida Department of Revenue doesn’t tell you

- Don’t rush to turn in documents without knowing what they entail. What you turn over can be used against you.

- Never assume the auditor is there to help you. Their mission is to find mistakes.

- Get help. Sometimes it’s better to pay someone who knows than to risk making costly mistakes.

- Keep EVERYTHING. Even that receipt you thought would never work.

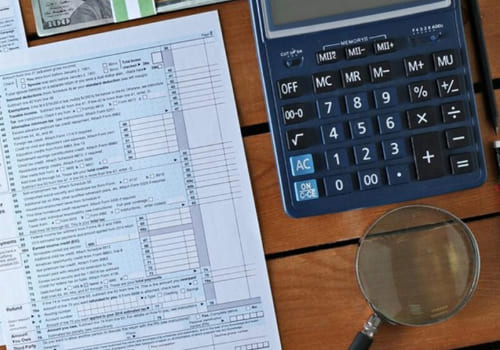

In the end, it’s more than numbers… it’s your peace of mind

A sales tax audit in Florida may sound like a bureaucratic red tape. But, for many of us, it’s an emotional roller coaster: fear, confusion, anger, exhaustion… and sometimes relief.

I’m telling you because I’ve lived it: if you’re not prepared, the process crushes you. But if you inform yourself, ask for help and act smart (even if your hand is shaking), you can get through it.

Have you ever had to deal with a tax audit?

Did you feel it was fair, or rather an ambush with unclear rules?

Talk to me, this is not discussed often enough, and perhaps your experience will serve as an example to someone.

You want to know more of how to protect yourself not only legally but tactically in these matters? I can give you details. I would love to. However, breathe, first! You are not the only one.